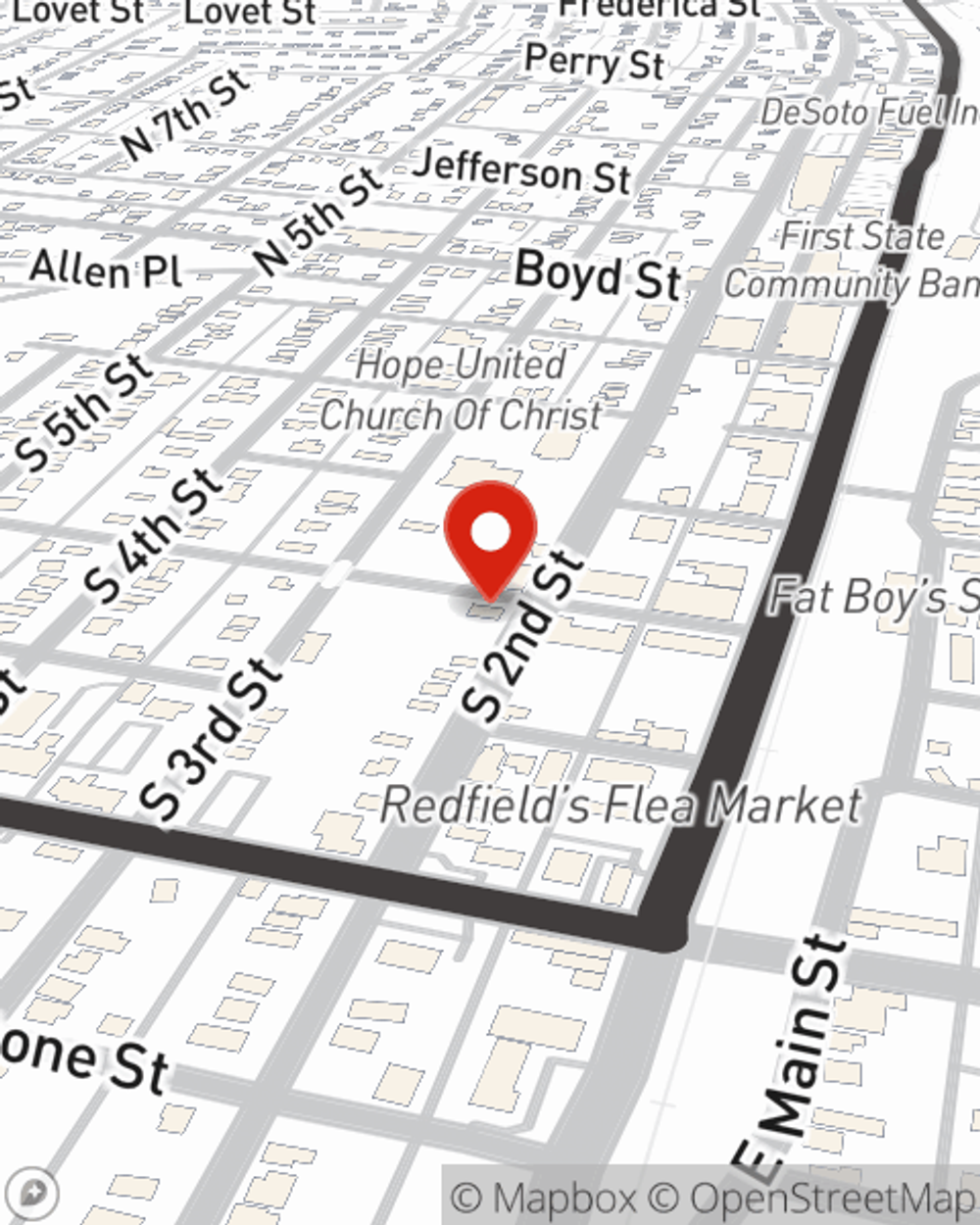

Condo Insurance in and around De Soto

Unlock great condo insurance in De Soto

State Farm can help you with condo insurance

Your Search For Condo Insurance Ends With State Farm

Because your condo is your safe place, there are some key details to consider - location, future needs, size, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you terrific coverage options to help meet your needs.

Unlock great condo insurance in De Soto

State Farm can help you with condo insurance

Protect Your Condo With Insurance From State Farm

With this coverage from State Farm, you don't have to be afraid of the unforeseen happening to your most personal possessions. Agent Sandy Meurer can help lay out all the various options for you to consider, and will assist you in creating a wonderful policy that's right for you.

De Soto condo owners, are you ready to explore what the State Farm brand can do for you? Call or email State Farm Agent Sandy Meurer today.

Have More Questions About Condo Unitowners Insurance?

Call Sandy at (636) 586-2227 or visit our FAQ page.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Sandy Meurer

State Farm® Insurance AgentSimple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.